Sustainable Energy in America 2026 Factbook

Tracking Market & Policy Trends

The Sustainable Energy in America Factbook provides valuable year-over-year data and insights on the American energy transformation.

Six Takeaways from the 2026 Factbook

Year after year, the Factbook provides energy statistics on market performance and analysis of the trends in energy efficiency, natural gas, renewable energy and other energy segments. Here are BCSE’s top takeaways from the 2026 Factbook:

Learn more and download the 2026 Factbook here:

Sustainable Energy Technologies Met Rising Demand Growth

in 2025 Despite Uncertainty

1

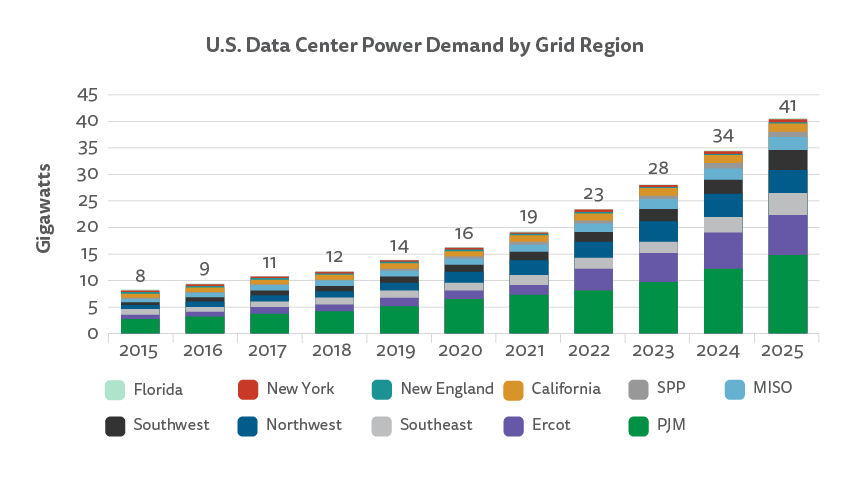

Energy demand is growing, driven by data centers.

Data center demand has quintupled in the past 10 years.

- In 2025, U.S. electricity demand rose considerably for the first time in decades. Overall, retail demand for electricity climbed 2% year-on-year in 2025 and was up 8% over the past decade following more than a decade of near-flat electricity demand.

- Data centers are now a dominant force behind rising U.S. power demand and the associated impact on the grid. Data center electricity demand has quintupled in the past 10 years and grown 150% in the last five years.

- Development shows no signs of slowing. Through the first quarter of 2025, a cumulative 23 gigawatts (GW) of data center IT capacity was live in the United States, with 48 GW under construction or committed to be built.

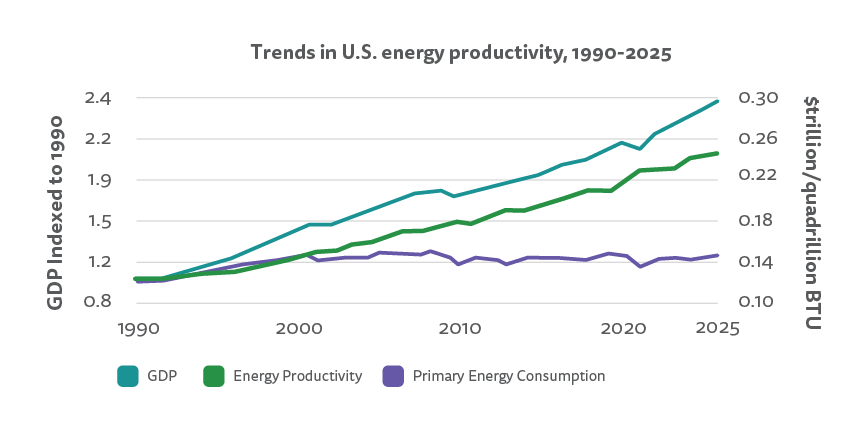

U.S. energy productivity continued to trend upwards.

- Across the entire U.S. economy, total primary energy consumption ticked up 1.2% in 2025 but was outpaced by growth in the gross domestic product (GDP) of 2%. This equals a 0.8% increase in energy productivity.

- Over the past decade, U.S. energy productivity has increased 24.2%.

- Energy productivity is a measure of economic output per unit of energy consumed in the United States. Its growth over the past decades is the result of investments in energy efficiency technologies, which have allowed consumers to save billions of dollars while improving U.S. economic competitiveness.

2

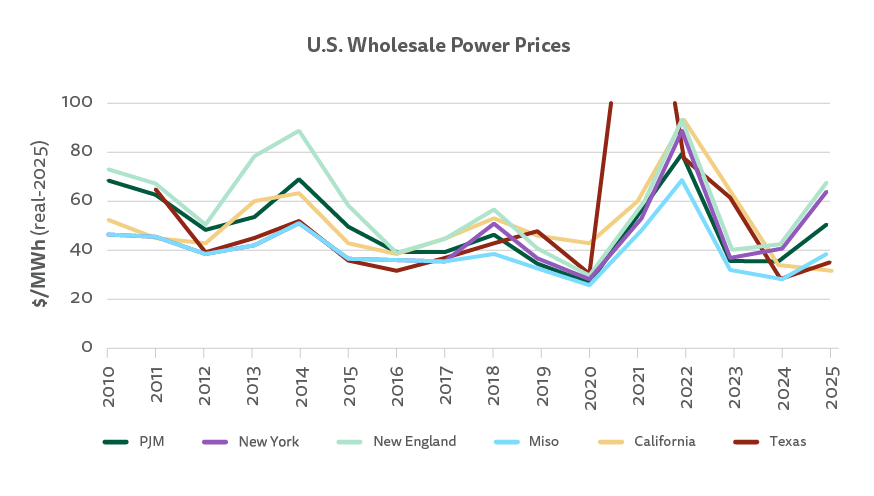

Amid affordability concerns, wholesale power prices increased sharply in 2025, and retail prices inched up slightly.

Electricity prices saw renewed political focus in 2025.

- Wholesale power prices increased sharply in the natural gas-heavy Northeast and Mid-Atlantic regions, reflecting higher gas prices, pressure on capacity markets and grid constraints. Prices rose 62% year-on-year in New York State, 60% in New England, and 45% in the PJM power market that stretches across 13 states and the District of Columbia.

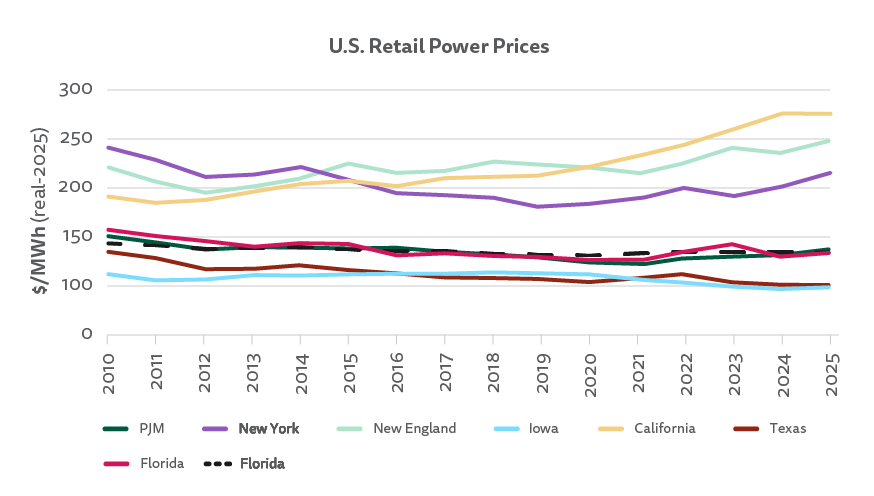

- Despite growing focus on specific markets, retail prices nationally inched up just 2.3% year-on-year.

- Over the past decade, U.S. residential electricity prices have risen 32%.

Energy costs for consumers – including natural gas and electricity bills, as well as motor fuel prices – rose to the top of the national conversation in 2025.

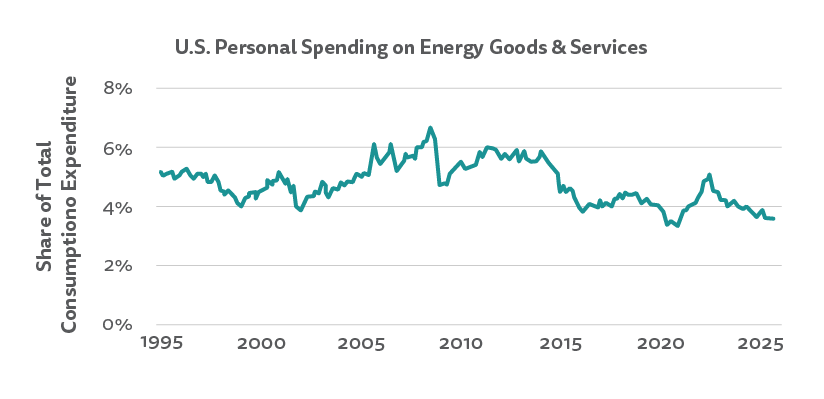

- The 2026 Factbook reports that total consumer spending on energy as a share of personal expenditures fell 0.2 percentage points year-over-year, to 3.66%. On average, 2025 gasoline prices were lower than in 2024.

- The combined share of electricity and natural gas costs as part of total household expenditure rose to 1.62% from 1.60% in 2024. This marks a departure from recent years of declining natural gas prices and is consistent with strengthening power sector demand, including growing electricity use from data centers.

3

A broad portfolio of sustainable energy solutions is meeting this demand.

Deployment of energy efficiency, renewable energy, energy storage, natural gas and sustainable transportation continued to grow across the country in 2025, driving U.S. power generation to a 20-year high.

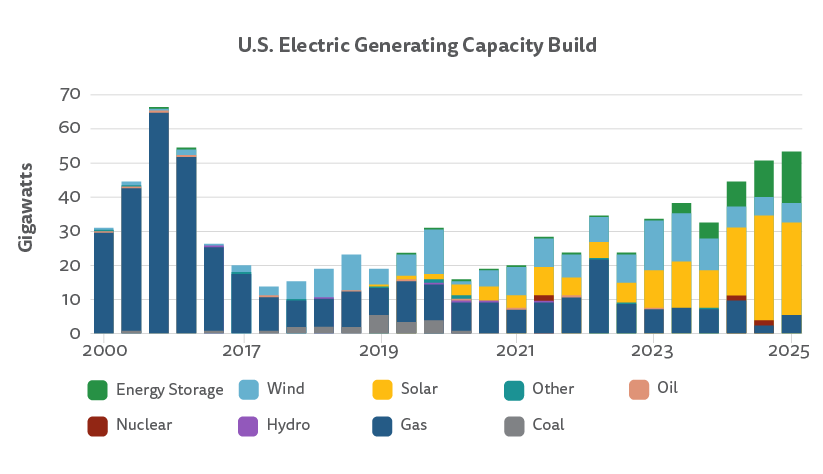

- The United States built the most new power-generating capacity in more than two decades in 2025, with 54 GW of new utility-scale generation and storage capacity commissioned.

- Natural gas capacity additions doubled year-on-year.

- With the push to add new electric generation, capital deployed to support expansion and reinforcement of the grid also rose to a record $115 billion in 2025.

- Grid-enhancing technologies (GETs) are emerging as a fast, cost-effective response to meet expanding renewable power generation and surging electricity demand. These technologies include reconductoring, dynamic line rating, advanced power flow control, topology optimization, and storage as transmission.

- U.S. electric vehicle (EV) sales reached a record 1.6 million vehicles in 2025, 3.7% higher than 2024, reflecting consumer uptake ahead of the phaseout of federal tax credits in October 2025.

-

As of end-2025, 23,686 propane-fueled school buses were deployed in 48 U.S states, with 15 states having more than 500 propane buses on the roadways.

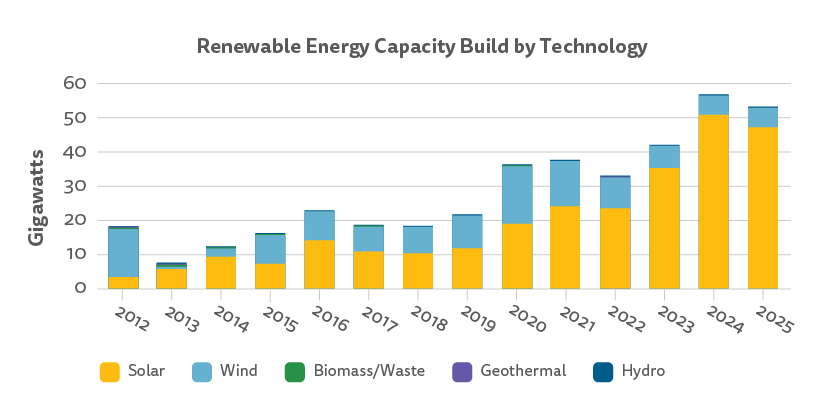

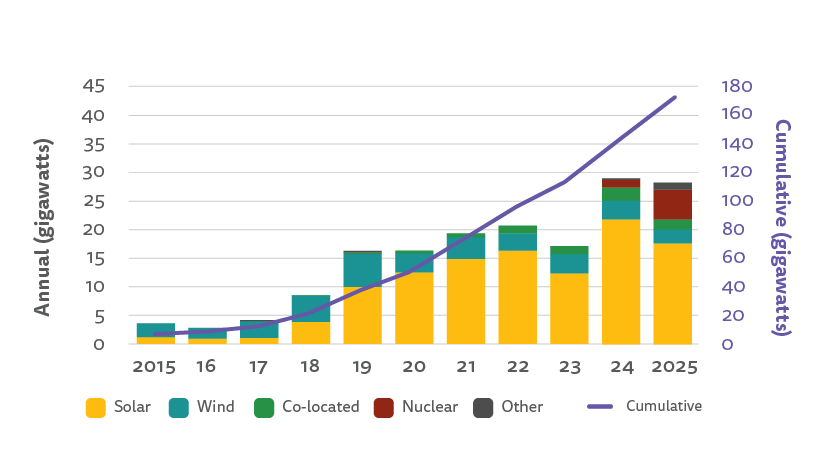

New solar, storage capacity led the way in 2025.

- Renewables accounted for 61% of new power-generating capacity, with utility-scale solar leading with 27 GW of alternating current capacity commissioned.

- Annual onshore wind power installations grew about 30% year-over-year, the first rebound after four years of decline.

- New biomass, geothermal and small hydropower build also grew, but at lower levels.

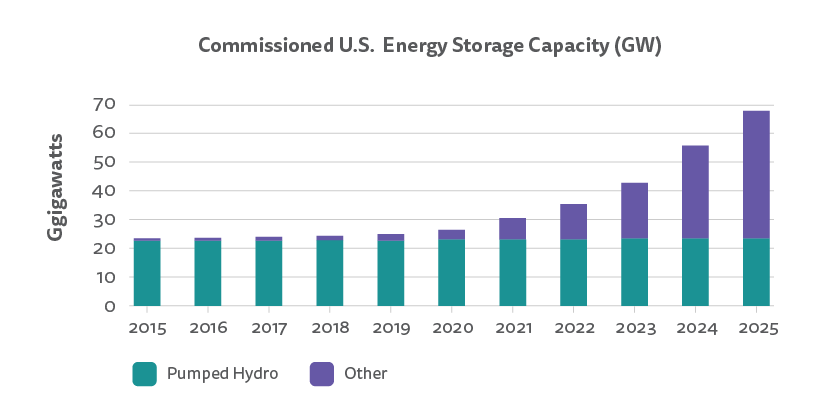

- Utility-scale energy storage emerged as a central component of new U.S. generation capacity, with a record 15 GW added in 2025, up 35% year-on-year.

- Pumped hydropower remained the largest grid storage capacity source (34% by GW and 65% by GWh).

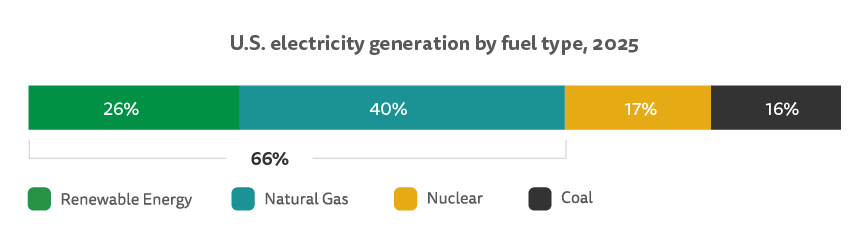

Natural gas and renewables provided two thirds of U.S. power in 2025.

- U.S. electricity generation reached its highest level in 20 years, rising 2.8% year-over-year.

- Natural gas provided 40% of total electricity generation in 2025.

- Renewable energy’s share – including wind, solar, biomass, waste-to-energy, geothermal and hydropower – grew to 26%, rising fastest among all power sources.

- Together, natural gas and renewables provided 66% of U.S. electricity in 2025, up from 41% a decade ago. Zero-emission sources – renewables and nuclear – accounted for 43% of all power.

- Coal provided 16% of generation.

4

Far-reaching and unpredictable policy changes provided both challenges and opportunities for the energy sector in 2025.

The growth in energy investment and deployment in 2025 came even as the industry grappled with uncertainty driven by federal policy changes.

- No less than 87 new U.S. trade and tariff policies were announced in 2025, creating unpredictability for companies and investors with exposure to cleantech supply chains.

- Businesses relying on the 10-year timeline of federal tax incentives enacted in 2022 had to adjust development plans, as many credits were abruptly phased out in late 2025.

- Federal permitting revocations and restrictions, especially impacting wind and solar projects, added additional delays to already lengthy approval timelines.

U.S. energy infrastructure needs reform of regulatory timelines and processes to accelerate the pace of energy expansion and meet rising demand.

- The slow pace at which infrastructure projects are able to secure necessary permits and advance remains a key obstacle for energy deployment.

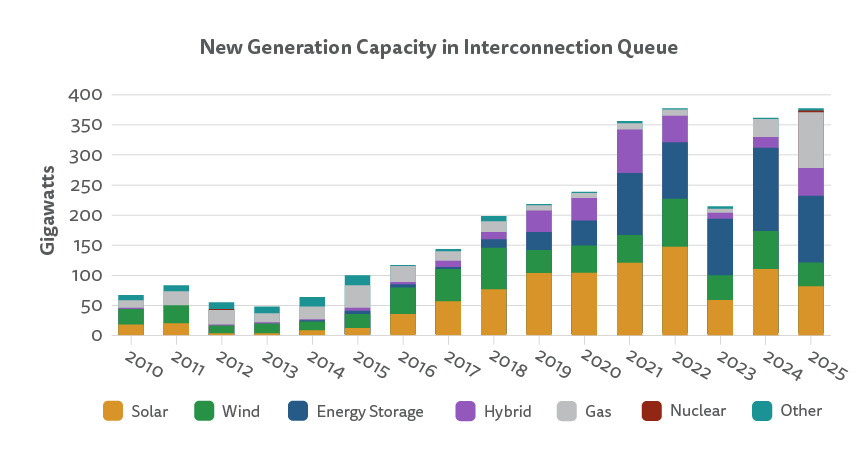

- In 2025 alone, 377 GW of new capacity applied to interconnect in the seven U.S. independent system operators, with energy storage projects making up the majority. It can take years for these projects to connect to the grid and bring power online.

- From transmission rights-of-way to carbon sequestration, reforms to federal permitting and siting regulations could help alleviate these difficulties and accelerate the pace of U.S. energy expansion.

Faster deployment timelines are critical to meeting rising demand while limiting ratepayer costs.

- As electricity demand rises, bringing new generating capacity online quickly is paramount. Many regional grids lack abundant spare power capacity, and power-hungry assets like data centers will prioritize markets where new supply can be developed alongside demand.

- Of utility-scale power sources, solar generally offers some of the shortest lead times, averaging 14 to 24 months in regions like California, ERCOT, MISO and the Southeast.

- New natural gas capacity involves some of the longest and most variable lead times, especially in regions like PJM, due to permitting and infrastructure constraints.

5

Investment in technology, innovation and manufacturing continued in the United States and abroad.

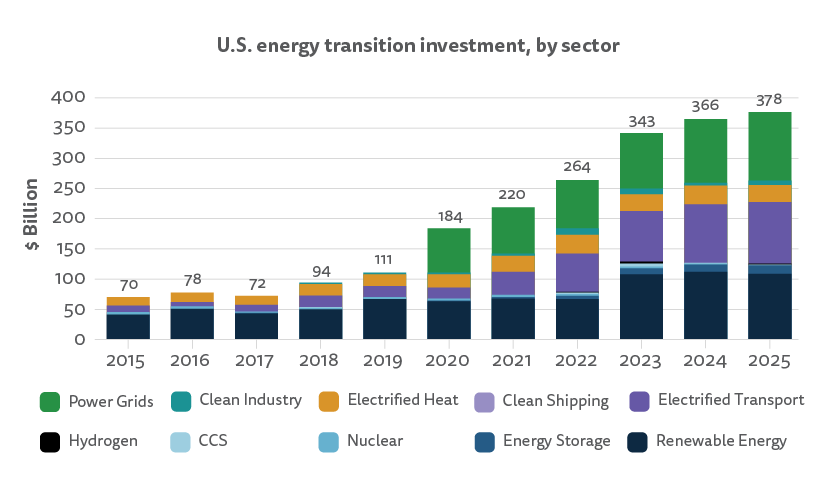

U.S. investment across the energy transition grew 3.5% in 2025.

- U.S. investment across all the energy transition sectors that BloombergNEF tracks – including renewables, electrified transport, decarbonization of industrial processes, and grids, among others – grew 3.5% year-on-year to a record $378 billion. This total is equivalent to 1.2% of 2025 U.S. GDP.

- As electricity demand surged with the build of artificial intelligence (AI) infrastructure in 2025, investment in the U.S. electricity grid jumped 9.5% to $115 billion.

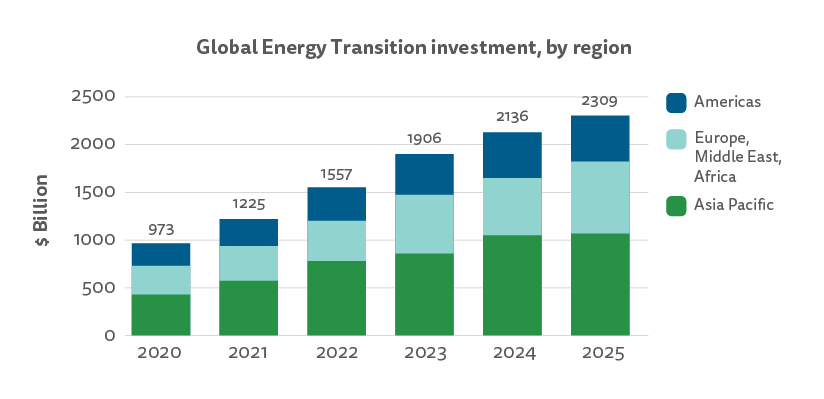

Global investment in sustainable energy once again shattered records in 2025.

- Globally, sustainable energy investment reached over $2.3 trillion in 2025. China continued as the global leader with $800 billion in 2025 investment, equivalent to about 4.1% of the country’s estimated GDP.

Corporate demand for clean, 24/7/365 power soared in 2025.

- Corporate power purchase agreements signed for zero-carbon electricity reached 29.5 GW in 2025, the highest annual total on record.

- The year was marked by a growing share of nuclear, hydropower, and geothermal contracts as tech giants doubled down on clean, baseload power for AI data centers.

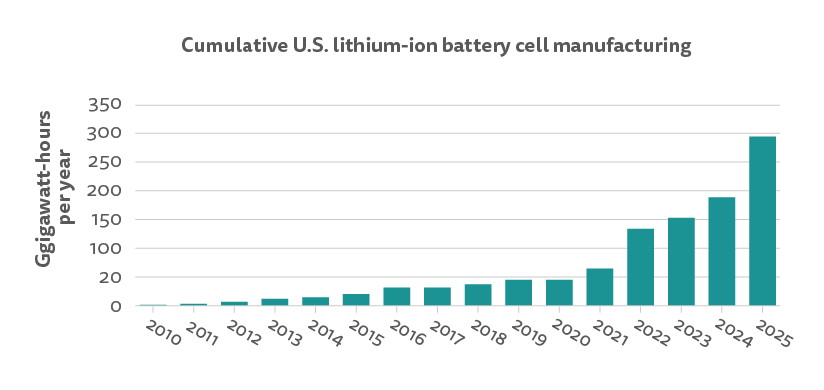

The creation of U.S. domestic supply chains remained a priority in 2025.

- By the end of 2025, the United States had 295 gigawatt-hours (GWh) of annual lithium-ion battery manufacturing capacity, a 56% increase year-on-year.

- However, nearly 10% of the announced investment in clean tech supply chains since the passage of the Inflation Reduction Act was cancelled following the rollback of incentives under the One Big Beautiful Bill Act (OBBBA) in 2025.

- The U.S. South has attracted manufacturers with low-cost electricity, favorable tax regimes, inexpensive land, and flexible labor markets, reinforced by generous state-level incentives. Solar manufacturing is especially concentrated in the South, led by spending in Texas and Georgia.

6

Greenhouse gas emissions are rising, and impacts of extreme weather reached $800 billion in 2025.

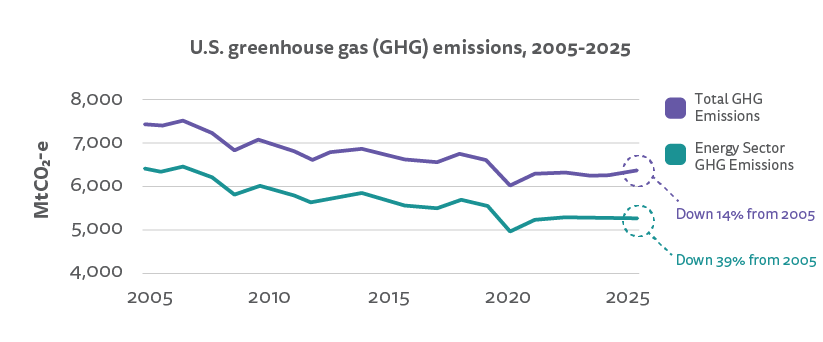

U.S. economy-wide greenhouse gas emissions rose in 2025.

- U.S. economy-wide greenhouse gas emissions rose 1.7% in 2025 but have fallen 5.4% over the past decade. Emissions in 2025 were 14% below 2005 levels.

- Power sector emissions increased 3.6% in 2025, largely due to growing demand and the rebound of coal generation. Ultimately, power sector emissions were 39% below 2005 levels.

- Transportation remained the top emitting sector, although its total emissions declined 0.6 % in 2025 as the sector slowly continued to electrify. The industry and power sectors followed in second and third place, respectively.

- Emissions from the buildings sector grew 5.9% in 2025.

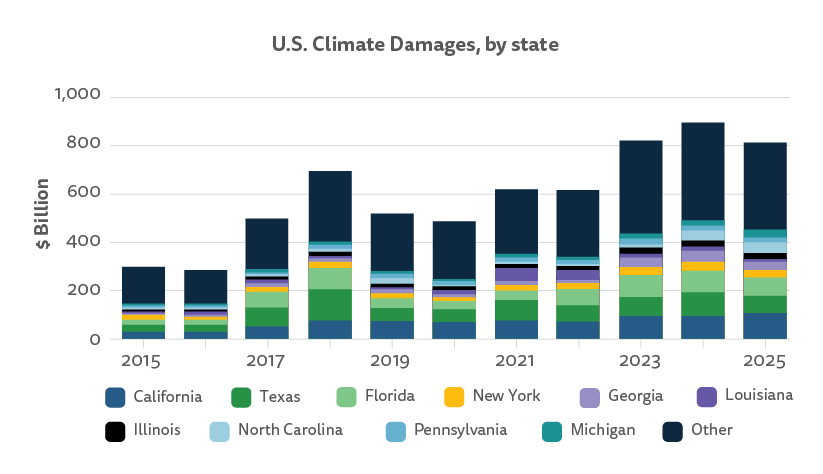

The U.S. financial costs of climate change reached $800 billion in 2025, equivalent to 2.6% of GDP.

- Damages were highest in heavily-populated coastal states like California, Texas, Florida, and New York, exposed to wildfires, hurricanes and flooding. The January wildfires in Los Angeles and ongoing recovery efforts from Hurricane Helene were particularly costly in 2025.

- Utilities are investing to fortify the electricity grid against growing wildfire, storm and other climate risks. Spending on undergrounding power lines has risen nearly 80% over the past decade, reaching $9.3 billion in 2024.