Sustainable Energy in America 2024 Factbook

Tracking Market & Policy Trends

The Sustainable Energy in America Factbook provides valuable year-over-year data and insights on the American energy transformation.

Key Trends

The 2024 Sustainable Energy in America Factbook, produced annually by BloombergNEF in partnership with the Business Council for Sustainable Energy, tracks energy market and policy trends in the United States. The Factbook examines how clean energy sectors performed in 2023 and over the past decade.

Learn more and download the 2024 Factbook here:

Clean Energy Transition Thrives, Boosted by Federal Policies

1

America’s position in the global clean energy economy is strong. In 2023, the U.S. energy transition demonstrated its resiliency, with investment and deployment bolstered by a suite of federal policies.

With the clean energy transition already hard-wired into the U.S. economy, investments surged in the first full year after the passage of the Inflation Reduction Act (IRA) in August 2022. In 2023, the U.S. saw market growth both in more mature clean energy technologies and in previously slow-growing, emerging decarbonization solutions.

Top market responses to the IRA tracked by the Factbook include:

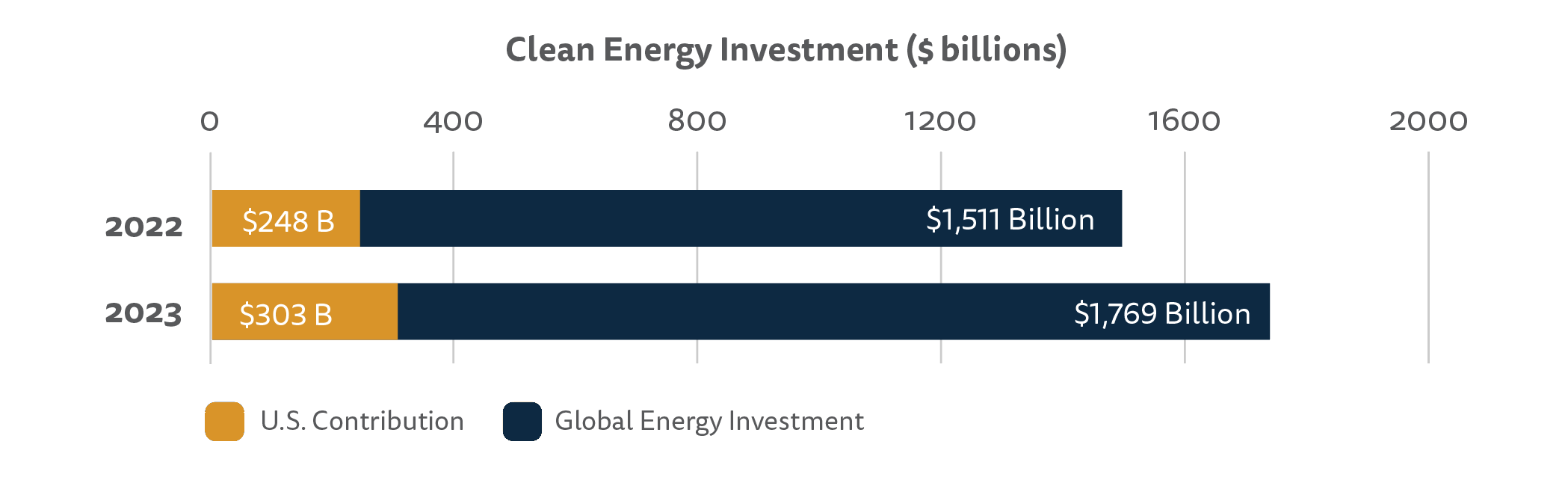

- PRIVATE SECTOR INVESTMENT: A record-shattering $303.3 billion in energy transition financing was deployed in the U.S. in 2023 for clean energy technologies, including renewable energy, electric vehicles, power grid investment and others.

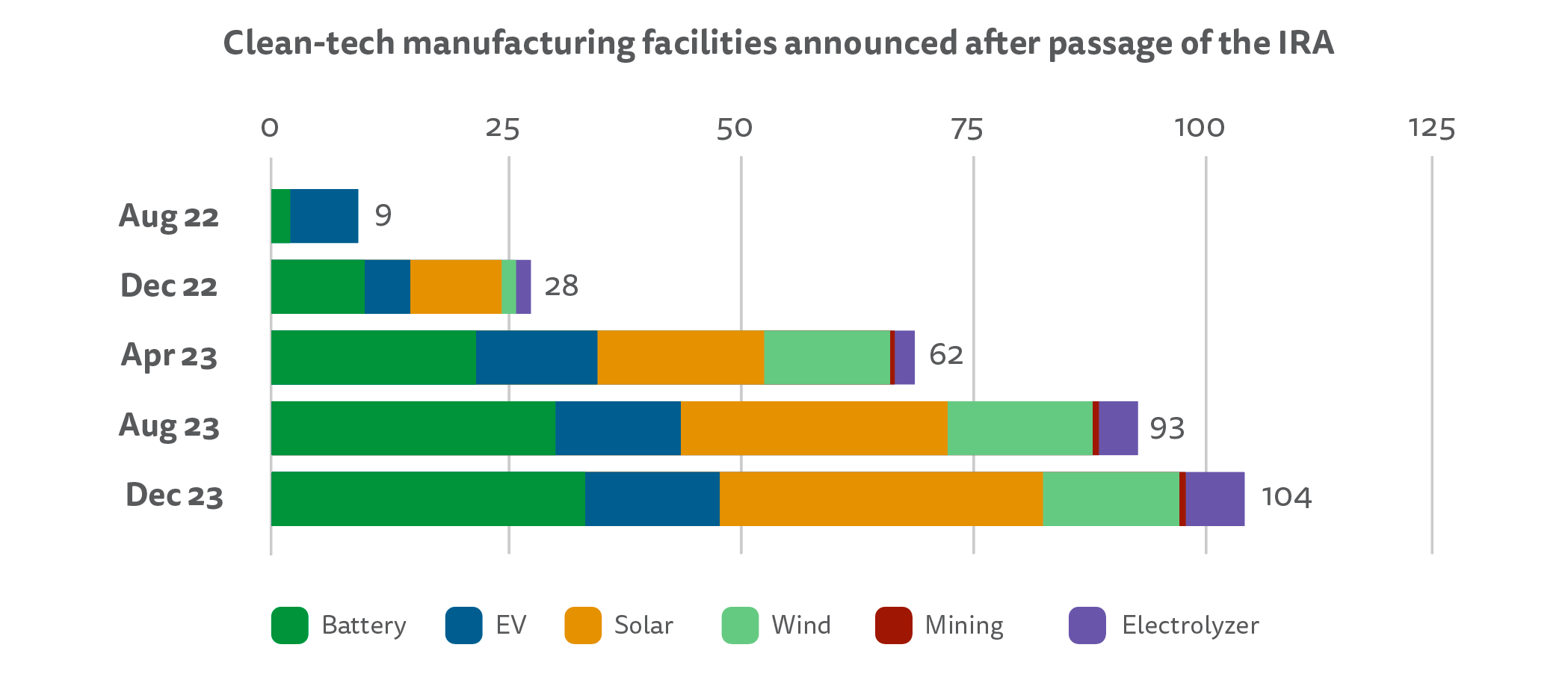

- MANUFACTURING: By the end of 2023, the number of manufacturing facilities planned across North America in response to the IRA rose to 104, representing $123 billion in announced investments. Battery and solar facilities dominate, with 34 facilities planned in each sector.

- RENEWABLE ENERGY: 42 gigawatts (GW) of new renewable power-generating capacity was added to the U.S. grid, driven mainly by robust solar additions.

- ENERGY STORAGE: 7.5 GW of battery storage capacity was commissioned in the U.S. in 2023, a new record for the country. The U.S. is the second largest market globally for energy storage demand.

- ELECTRIC VEHICLES (EVS): EV sales in the U.S. surged 50 percent to nearly 1.46 million vehicles sold. The surge was driven by new EV incentives, price cuts and more EV models released.

- CARBON CAPTURE AND STORAGE (CCS): New investments in CCS totaled $2.8 billion, up 68 percent from 2022. Around 137 million metric tons annually (Mtpa) of new CCS projects are being planned in the U.S., against an installed base of 23 Mtpa in 2023.

- HYDROGEN: Investments in hydrogen-producing projects totaled $1.9 billion in 2023, up 82 percent from 2022. A record 437 megawatts of new electrolyzers were shipped to the U.S., a 680 percent year-on-year increase.

- RENEWABLE NATURAL GAS (RNG): U.S. RNG production capacity grew 13 percent in 2023. States that have passed or proposed “green gas” tariffs to enable utilities to use RNG include AR, CA, CO, IA, ID, IL, KS, MA, MI, NC, NE, NH, NJ, NY, OK, OR, PA, UT, VA, VT and WA.

- SUSTAINABLE AVIATION FUEL (SAF): Supply of renewable diesel and jet fuel, also known as SAF, rose 53 percent and 81 percent respectively in 2023. Globally, airlines signed a total of 36 agreements to procure SAF from January to early December. U.S.-based airlines led in procurement, likely due to government incentives such as investment tax credits under the IRA for SAF producers.

Global investment in the energy transition once again shattered records in 2023, soaring to $1.7 trillion, with the U.S. attracting $303 billion of investment, second to China’s $676 billion.

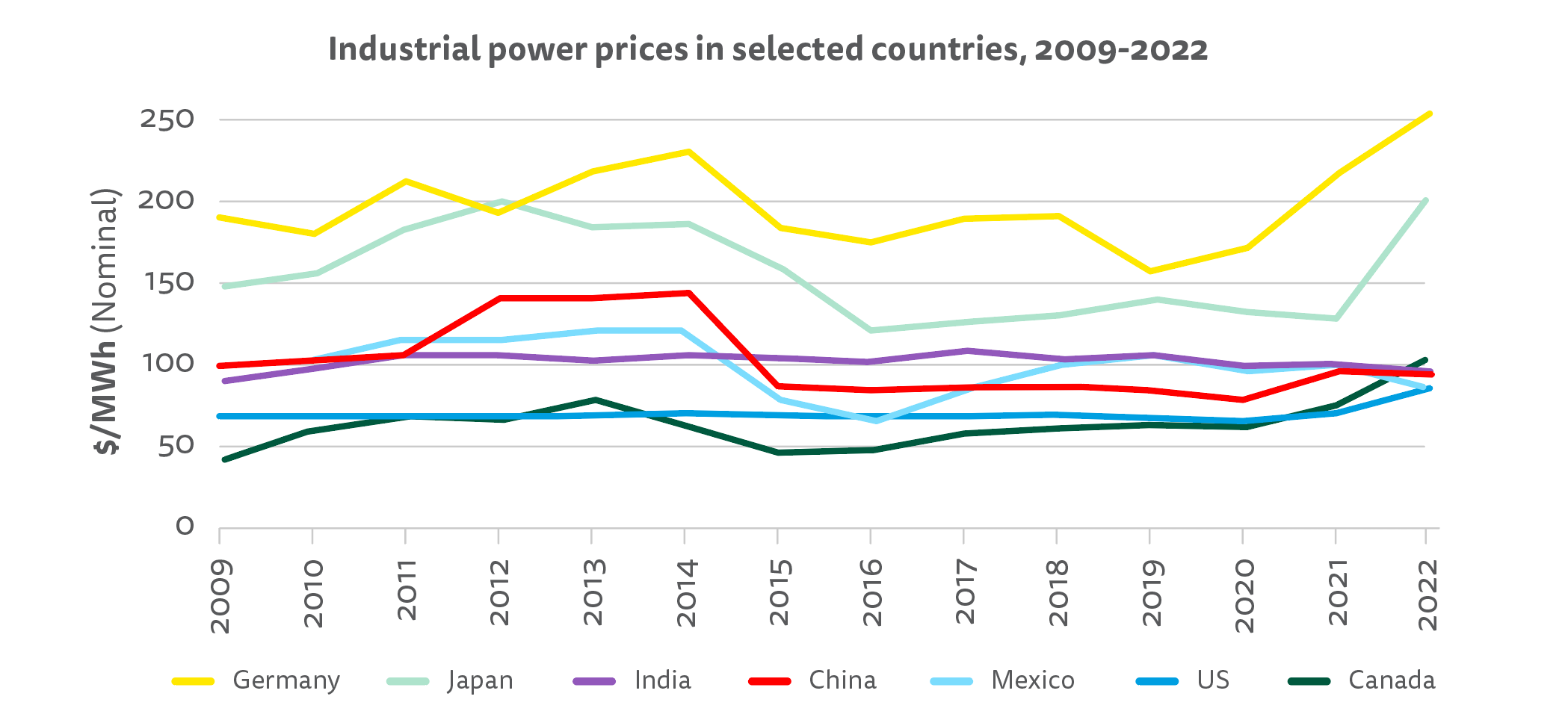

The U.S. – and North America in general – offers industrial customers some of the least-cost electricity in the world, averaging 8.6 cents per kilowatt-hour in 2022 (latest data available).

WHY IT MATTERS

The remarkable performance of clean energy markets in 2023, despite serious market headwinds, demonstrates the important role of federal policies to provide stability and a framework to guide industry growth. Despite higher interest rates and supply chain difficulties, as well as challenges presented by interconnection queues and lengthy permitting processes, the clean energy transition found a way to thrive in 2023 and continue its upward trajectory.

BCSE believes that IRA-led investments are securing America’s economic competitiveness and leadership position in the global market. The record levels of energy transition financing in the U.S. and globally in 2023 are a clear indicator that clean energy is big business.

2

In 2023, BCSE’s diversified energy portfolio of energy efficiency, natural gas and renewable energy proved foundational to the U.S. energy economy and its advancements.

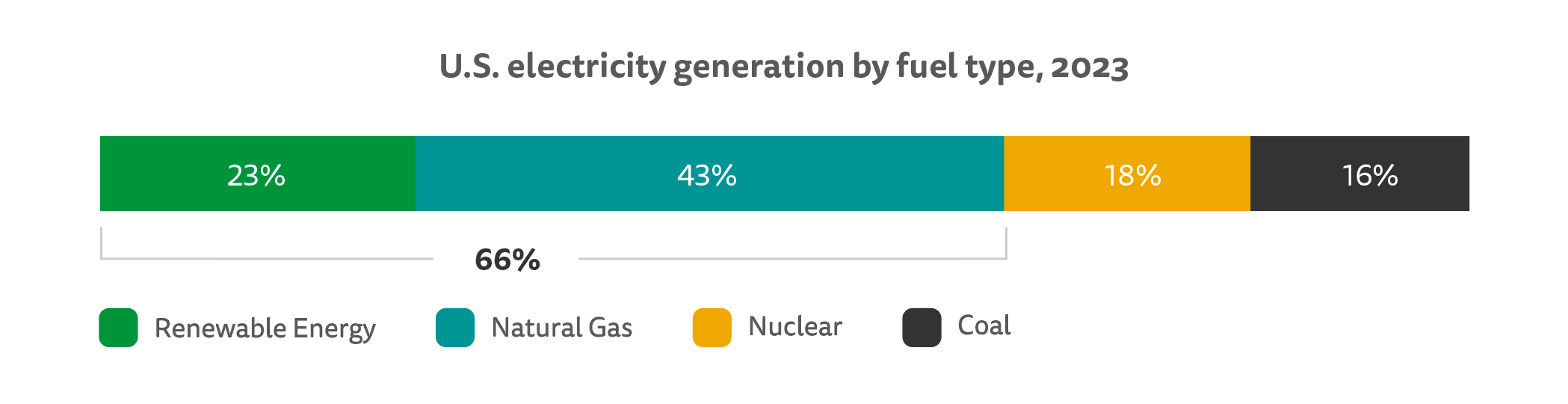

The BCSE portfolio of clean energy solutions provides the majority of U.S. electricity. In 2023, natural gas and renewable energy met 66 percent of U.S. electricity demand, up from 41 percent in 2013.

A CLOSER LOOK AT THE ELECTRICITY MIX IN 2023

- Total U.S. power generation decreased by an estimated 0.9 percent in 2023.

- Natural gas remained the largest source of U.S. electricity – providing 43 percent of the total – with 1,809 terawatt-hours (TWh) of production in 2023, up 6.5 percent from 2022.

- The contribution of all renewables – including biomass, geothermal, hydropower, solar, waste-to-energy and wind – rose 1 percent, producing 972 TWh in 2023. A drop in hydropower and wind output was offset by strong solar generation.

- Among renewable technologies, the 153 GW wind power fleet produced 428 TWh of electricity in 2023, followed by hydropower with 239 TWh and solar generating projects (utility-scale and rooftop solar) with 237 TWh.

- Zero-carbon power (renewable energy generation plus nuclear power) accounted for an all-time high of 41.1 percent of U.S. electricity output in 2023.

- Coal-fired generation fell to an all-time low of 15.8 percent of total U.S. power generation.

A CLOSER LOOK AT ELECTRICTY CAPACITY BUILD IN 2023

- An estimated 40.5 GW of new utility-scale power generation and storage capacity was commissioned in 2023 – the most in 20 years. Renewable energy was the dominant source, adding 24.1 GW of capacity in 2023. New natural gas-fired power generation capacity rose to 9 GW. Energy storage set a record for the fourth year in a row with 6.2 GW added.

- 2023 also marked the first year new nuclear power capacity was brought online since 2016.

- Total U.S. renewable energy capacity, excluding pumped hydropower facilities, reached 425 GW in 2023. Despite lingering concerns about supply chains, high interest rates, and trade policy worries, the installed fleet of wind and solar capacity grew 13.5 percent for the year.

WHY IT MATTERS

As the share of U.S. electricity provided by natural gas and renewable energy continued to climb in 2023, the U.S. economy grew while greenhouse gas emissions decreased. This portfolio of low- and zero-carbon resources also offers the flexibility needed to manage the electricity grid.

As the U.S. energy economy has transformed over time to embrace cleaner resources and become more energy efficient, the energy costs of U.S. consumers have remained relatively low and stable. In 2023, energy spending accounted for 4.2 percent of total U.S. personal consumption expenditures, down 0.6 percentage points from 2022, as the cost of gasoline fell, along with slight drops in the price of natural gas and electricity.

The benefits of the energy transition, however, are not necessarily equally distributed across the diversity of U.S. communities and regions. Importantly, the Inflation Reduction Act includes provisions that focus investment and aim to lower costs in underserved and low-income communities.

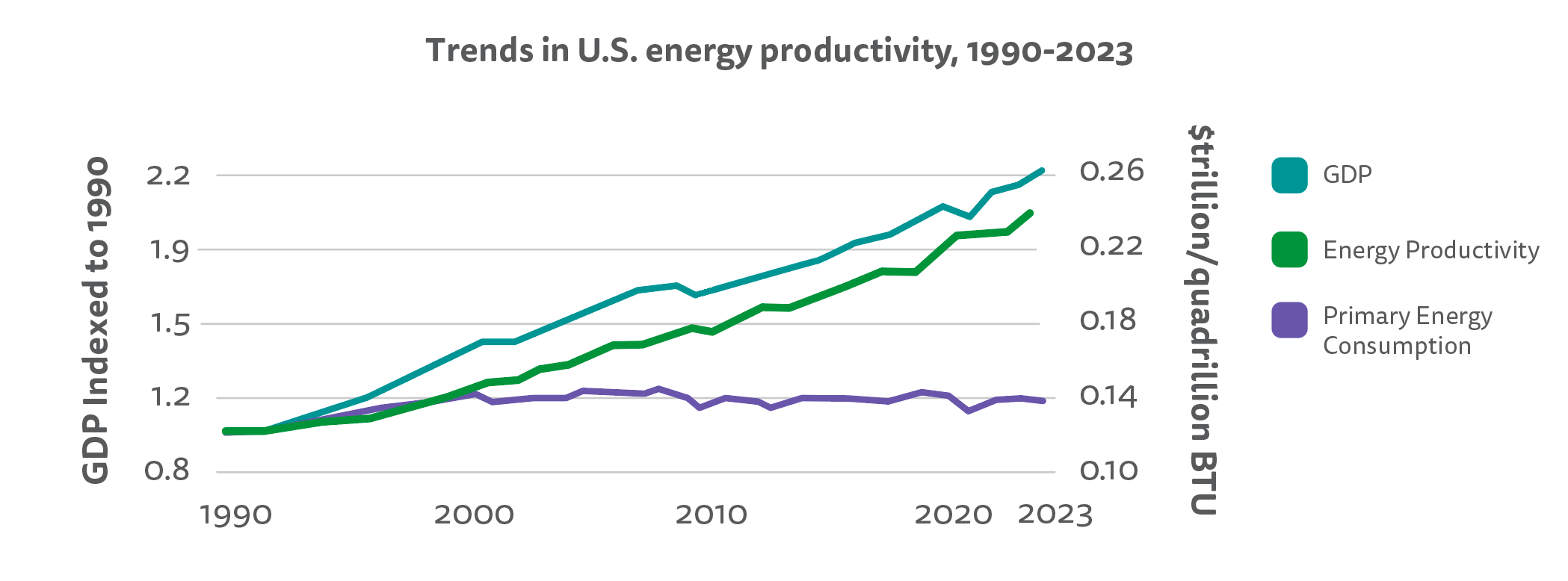

U.S. energy productivity increased by 3.8 percent in 2023, as the economy expanded 2.4 percent and U.S. primary energy consumption slowed by 1.4 percent. U.S. energy productivity has grown 30.6 percent over the past decade and has improved 101 percent since 1990.

WHY IT MATTERS

Energy productivity – a measure of economic output per unit of energy consumed in the U.S. – is an essential metric to grade our country’s competitiveness in the global market. The three-decade-long upward trajectory of U.S. energy productivity showcases the positive return on public and private sector investments in energy efficiency. Energy efficiency is an essential tool in the toolbox needed to meet U.S. decarbonization goals.

3

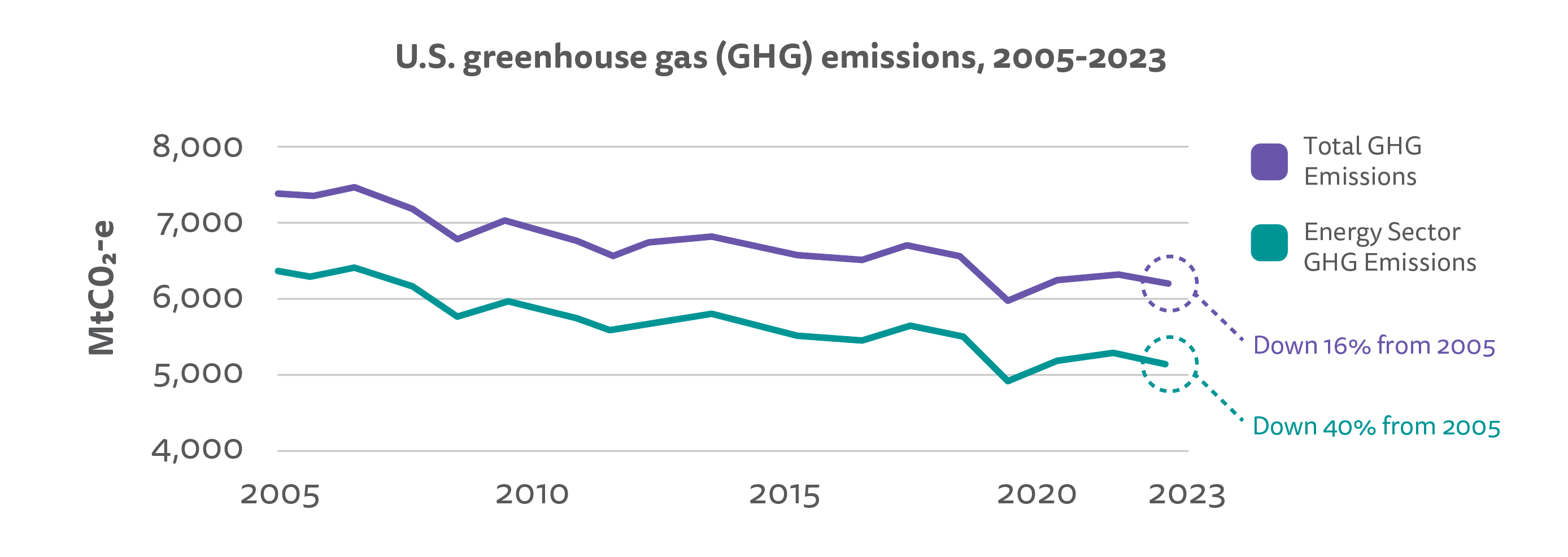

In 2023, U.S. greenhouse gas emissions returned to a much-needed downward trajectory, falling 1.8%, and led by reductions in the power sector. The U.S. also experienced the highest number of extreme weather events on record.

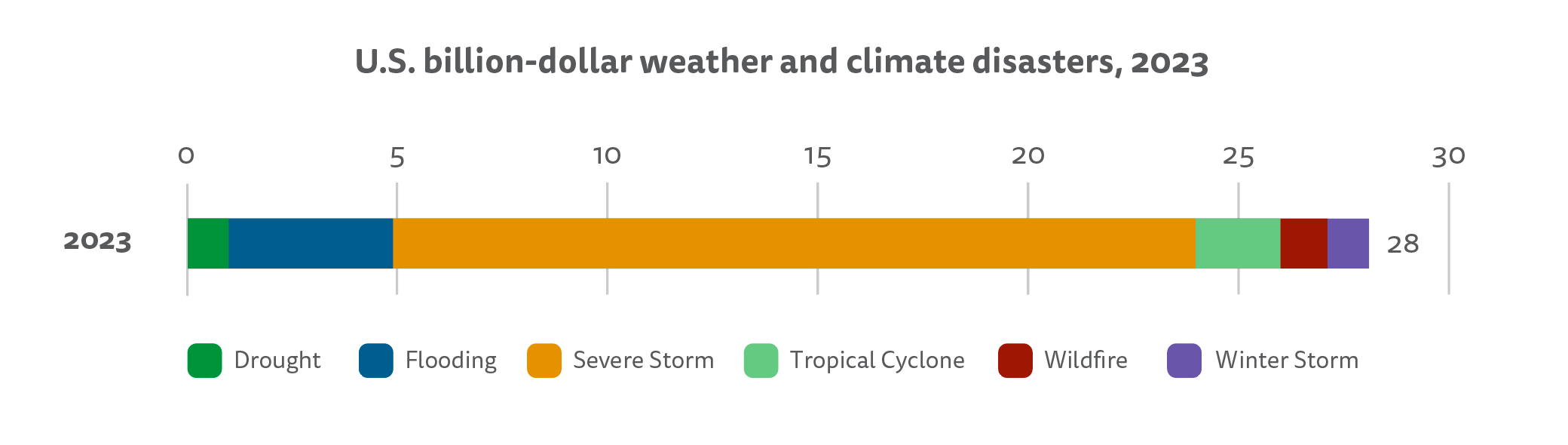

In 2023, the U.S. experienced 28 climate-related disasters, the highest number recorded, causing $92.9 billion in damages. Nineteen of these were severe storms that accounted for 58 percent of total financial damages. Since 2012, roughly 2.8 GW of microgrids, 5,000 megawatt-hours of energy storage, have been brought online. Microgrids are powered by solar, energy storage and diesel generation sets.

WHY IT MATTERS

U.S. emissions in 2023 were at their lowest levels since 1987, with 2020 the exception due to COVID-19 lockdowns. Emissions fell across all sectors except for transport. Progress remains concentrated in the power sector, which accounted for 83 percent of the overall drop in 2023. The bulk of emission reductions in the power sector to-date can be attributed to coal being displaced by natural gas.

Although it is a good sign that U.S. emissions have returned to their downward trajectory, the pace of reductions is not where it needs to be if the U.S. is to meet its current goal under the Paris Agreement to reduce economy-wide emissions 50-52 percent below 2005 levels by 2030. In 2023, U.S. emissions were down 16 percent over 2005 levels.

Additionally, at the 2023 United Nations Climate Change Conference (COP 28) in the United Arab Emirates, countries agreed to double the average rate of energy efficiency improvements worldwide by 2030, triple the capacity of renewable energy worldwide by 2030, and begin the transition away from fossil fuel energy systems, with the aim of reaching net zero greenhouse gas emissions by 2050. The call for accelerated pacing of the global energy transition has near-universal support, and the United States has the technology solutions that are needed.

Climate-related disasters place undue strains on public coffers and community well-being. The U.S. energy system is critical infrastructure that needs immediate attention to avoid the negative consequences of extreme weather and natural disasters.

What We Are Watching

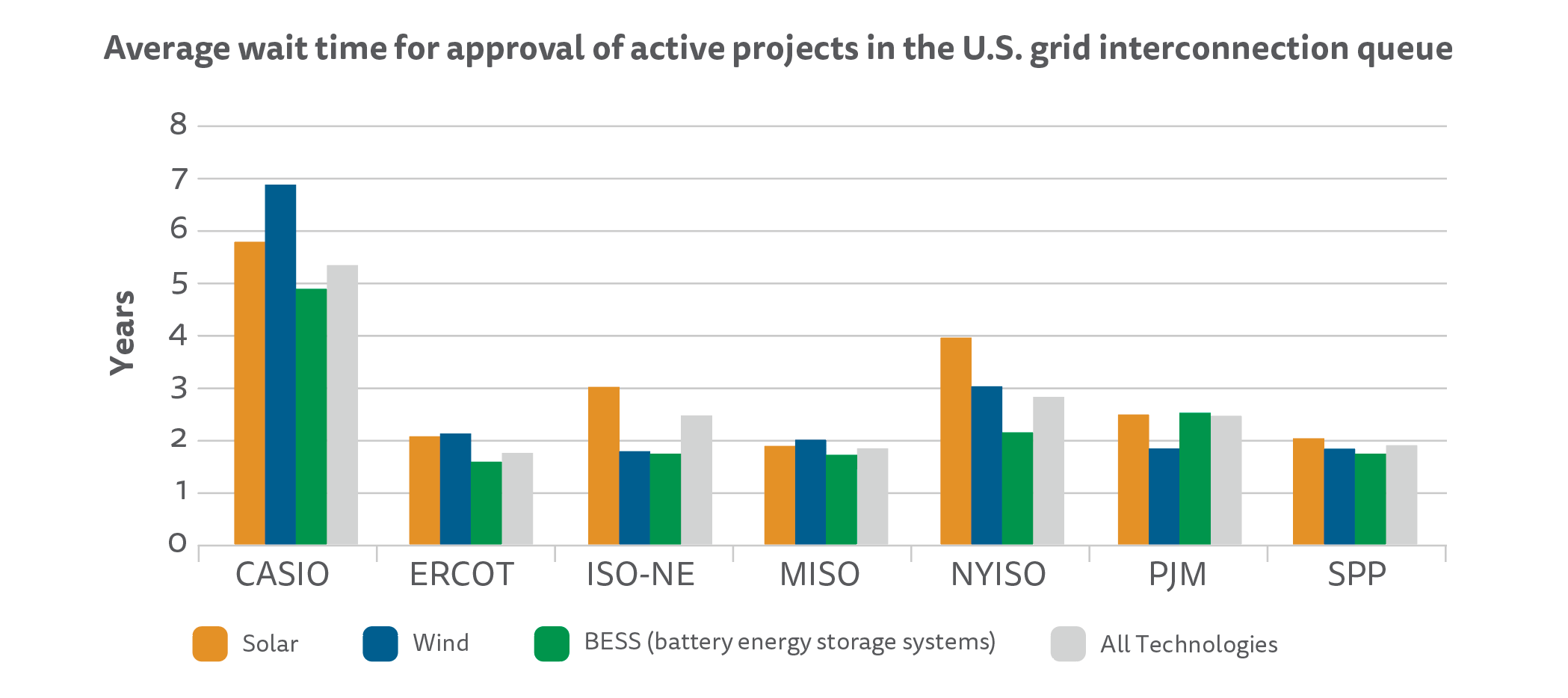

U.S. energy infrastructure needs reform of regulatory timelines and processes.

Take Away

As of January 2024, more than 1,100 GW of projects were undergoing interconnection studies in the seven U.S. independent system operators.

Dive In

Learn more on Factbook page 50.

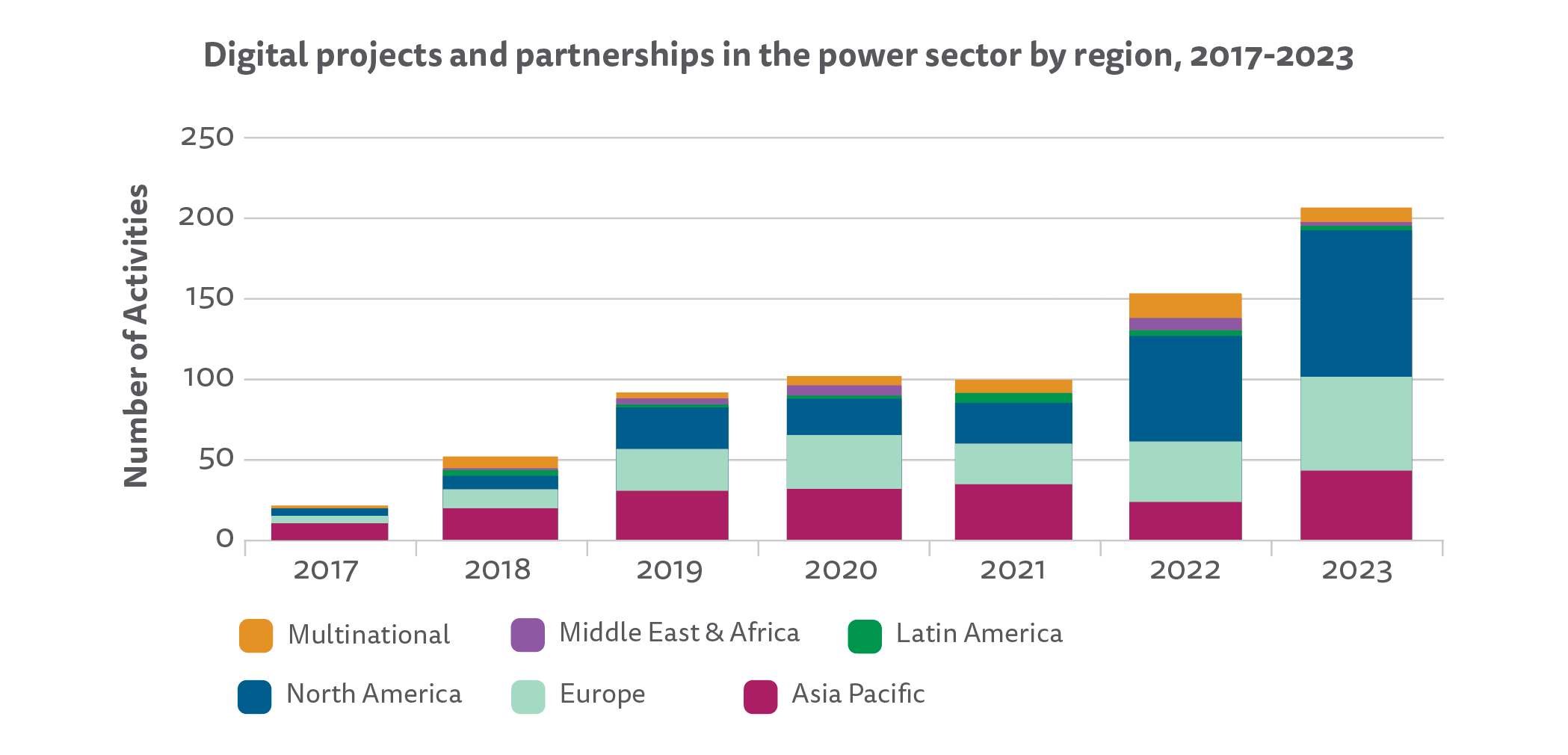

The U.S. has emerged as a global leader in power sector digitalization.

Take Away

The U.S. accounted for 40 percent, or 81 out of 206, of the total digital projects and partnerships in the global power sector in 2023. The top types of U.S. projects were grid control, analytics software, and sensors/edge control. Digital technologies are becoming a pillar in utility strategies worldwide, to help improve the efficiency of electricity grids, boost power system resilience, and integrate renewables and distributed energy resources.

Dive In

Learn more on Factbook page 49.

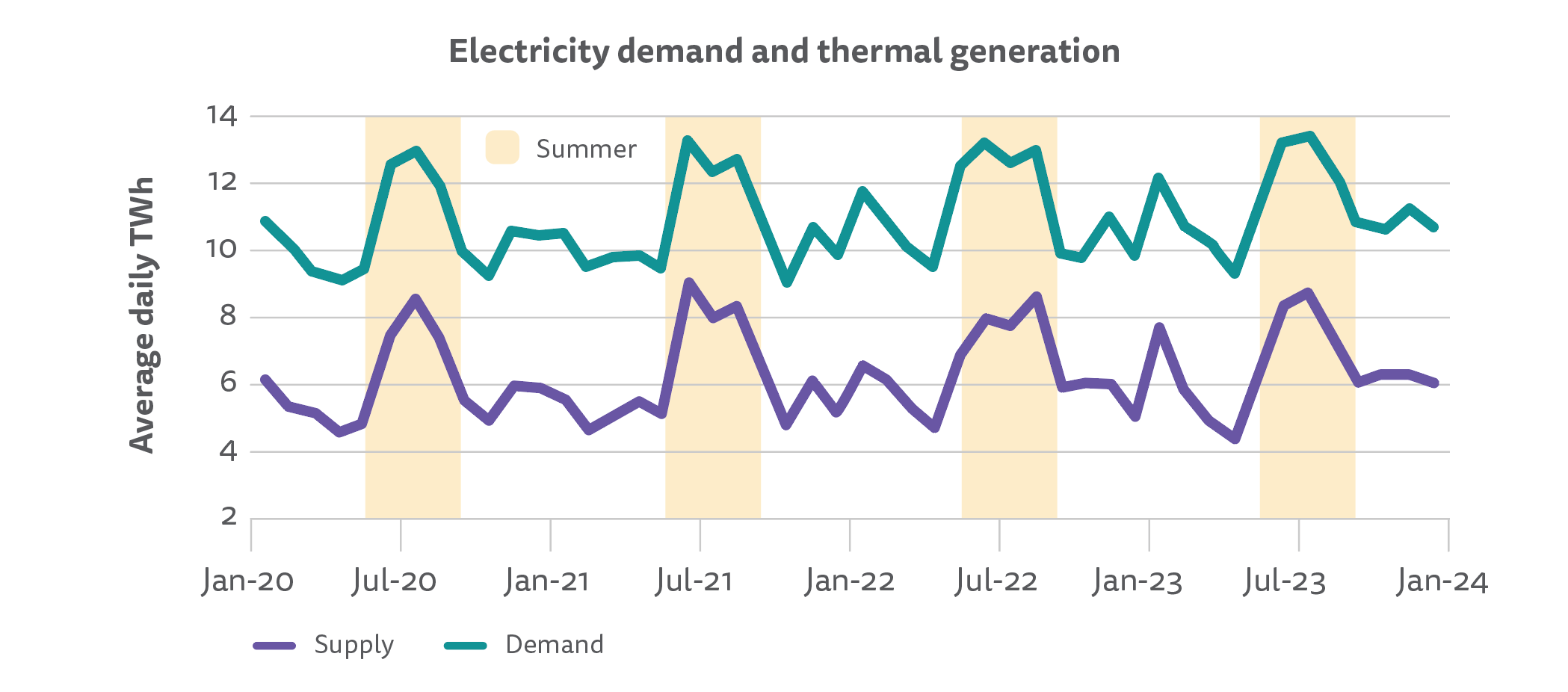

Seasonal energy storage must expand for the U.S. to adapt to climate change.

Take Away

As the U.S. experiences more high-heat and high-cooling days, the role of energy storage will grow

Dive In

Learn more on Factbook page 56.