By Lisa Jacobson, President, BCSE

As clean electricity demand continues to grow, market-based accounting has become one of the most effective tools to allow companies to manage their greenhouse gas emissions and drive investment in low- and zero-carbon generation.

This spring, the Business Council for Sustainable Energy (BCSE) has continued its work to shape revisions to several greenhouse gas reporting frameworks and risk disclosure policies. Our coalition submitted a letter to the Greenhouse Gas Protocol (GHG Protocol) this week, providing feedback on revisions to its Corporate Standard. The letter builds upon BCSE’s previously submitted comments from March 2023, which provided feedback on the role of Energy Attribute Certificates (EACs), market-based accounting, opportunities to improve transparency and the stakeholder process, and more.

Market-Based Accounting Drives Sustainable Energy Deployment

The current GHG Protocol framework enables credible climate leadership by allowing the use of contractual instruments, such as EACs, to account for purchased clean energy. These instruments are essential to financing new projects and are widely used across public and private sectors.

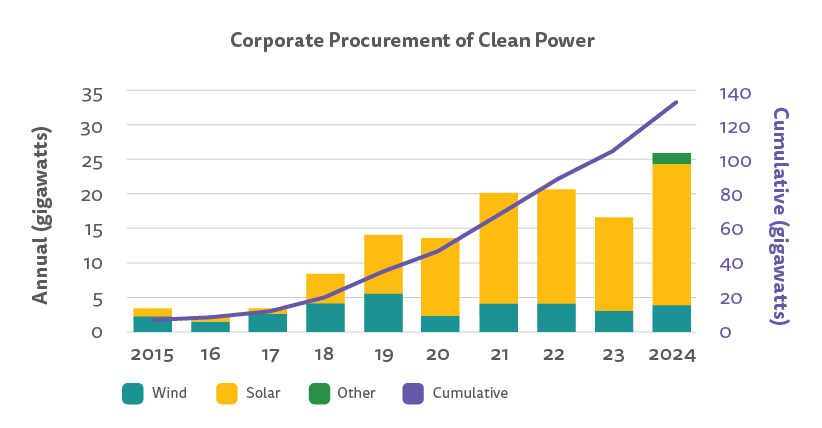

Source: 2025 Sustainable Energy in America Factbook

According to the 2025 Sustainable Energy in America Factbook, corporate clean energy purchasing reached new heights in 2024, with nearly 22 GW of long-term power purchase agreements (PPAs) announced in the United States alone. Virtual PPAs represented over 80% of this activity, reinforcing their role as a cornerstone of the voluntary clean energy market. These deals rely heavily on the continued eligibility of EACs in Scope 2 market-based accounting and have directly enabled the buildout of large-scale solar, wind, and storage capacity across the country. Over the last decade, voluntary buyers have driven more than 100 GW of new sustainable energy in the United States, according to research by the Clean Energy Buyers Association.

RE100 companies, which now number more than 400 globally, continue to prioritize certificate-based clean energy purchasing to meet ambitious climate targets. As the United States faces skyrocketing demand growth, narrowing the definition or use of market-based instruments could freeze investment, stall new projects, and undermine broader climate goals. Instead, a flexible, credible, and accessible Scope 2 framework will be critical to sustaining this momentum.

BCSE’s Recommendations

BCSE strongly urges the GHG Protocol to preserve and strengthen market-based accounting options in the Scope 2 framework. In the letter, we call on the GHG Protocol to:

- Maintain the current dual-method approach.

- Preserve flexibility in accounting and procurement options.

- Protect existing investments, and investments that are made prior to the finalization of new rules, by allowing the use of the existing corporate standard guidance.

- Expand, rather than narrow, participation.

- Clarify guidance for emerging technologies, including storage-backed clean electricity, location/time-matched procurement, and grid-interactive solutions, without disqualifying the approaches that are currently driving significant impact.

Now is the time to accelerate the tools that enable emissions reduction through voluntary clean energy procurement. The GHG Protocol can continue to lead by maintaining a balanced, inclusive approach that supports integrity, innovation, and investment.

About the Author: Lisa Jacobson is the President of the Business Council for Sustainable Energy.